$step 1 imperative hyperlink Gambling enterprise Deposit Extra Greatest step one Dollars Bonuses for 2025

Posted by: admin in UncategorizedPosts

- What sort of no-deposit gambling establishment incentives must i claim? – imperative hyperlink

- Monetary movie director

- Exclusion for the 50% Limitation to have Dishes

- Tips claim the brand new $1 deposit incentive from the Betting Pub

- Lost otherwise Mislaid Cash or Property

- Making use of your Personal computer

Additionally you don’t tend to be distributions out of your Roth IRA which you roll over tax-free to your some other Roth IRA. You may have to is element of most other withdrawals on the earnings. The other taxation to your early withdrawals is ten% of the amount of the early delivery you have to are on the revenues. So it taxation is within inclusion to your regular tax ensuing of like the distribution in the money. Only the area of the delivery you to definitely is short for nondeductible contributions and you will rolling over once-tax number (your prices basis) are tax free. Up until your entire foundation might have been distributed, per shipment is partially nontaxable and partly nonexempt.

- These are fees enforced by the a foreign country otherwise any kind of their governmental subdivisions.

- Online step three of your worksheet, they enter into $40,five hundred ($38,100000 + $2,500).

- You should fool around with an indicator words interpreter throughout the meetings while you reaches performs.

- Essentially, you can subtract assets taxes on condition that you are an owner of the house.

- Your didn’t allege the fresh part 179 deduction or perhaps the unique decline allotment.

What sort of no-deposit gambling establishment incentives must i claim? – imperative hyperlink

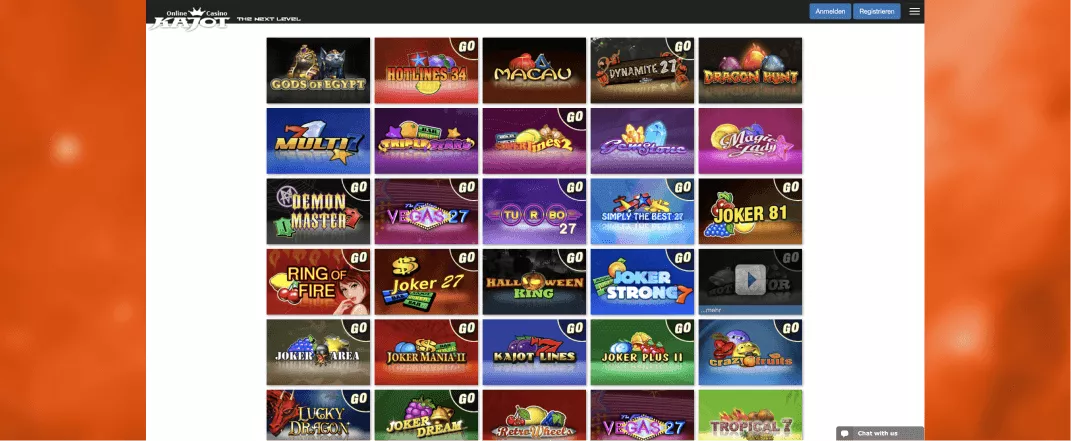

Because the term implies, this type of free spins do not have any wagering conditions. Web based casinos are content to do business with us because the we publish him or her valuable site visitors. In exchange, they’re going the other distance by providing you having exceptionally big bonuses that they could not have to market themselves internet sites. Developing solid long-identity dating having best casinos will bring us for the investment so you can negotiate exclusive bonuses you obtained’t see to your any webpages outside of NoDepositKings. I don’t exit your choice of by far the most winning gambling establishment bonuses to help you opportunity.

Discover Alternative Minimal Taxation (AMT) within the chapter 13 to learn more. 550, section 1 consists of a discussion on the personal activity ties under County otherwise State Debt. Income in the home is taxable for the son, apart from people part used to see an appropriate obligation to help you secure the son is actually nonexempt to the mother or guardian having you to definitely court obligations. Such regulations apply at both joint possession by a wedded partners and combined possession because of the rest. For example, for those who discover a shared family savings with your kid having fun with money from the boy, list the fresh child’s identity basic on the membership and present the newest children’s TIN.

Advantages received away from an employer-financed financing (that the imperative hyperlink employees didn’t contribute) aren’t jobless settlement. To find out more, find Supplemental Unemployment Payment Benefits inside the section 5 of Club. Report such repayments on line 1a away from Function 1040 otherwise 1040-SR. For many who sell your whole need for petroleum, gas, otherwise mineral rights, the quantity you will get is known as payment to your product sales away from property included in a trade otherwise team under section 1231, perhaps not royalty money. Under certain points, the newest product sales is actually susceptible to financing obtain otherwise losings therapy as the said regarding the Recommendations to own Agenda D (Mode 1040). For more information on promoting point 1231 property, find section step 3 of Bar.

Monetary movie director

Any of these casinos require that you withdraw more the fresh minimal deposit matter, even when – look out for which when playing at the lower minimum deposit casinos inside the October 2025. An informed United states of america no deposit web based casinos in the 2023 mix advertising now offers you to wear’t want a deposit with selections away from online game loves ports and you may black-jack. When a website have a customer service agency and you can an excellent reputation of to the-time percentage, a whole lot the greater. Throwing away money sucks, specially when it’s dropping a sink out of a great All of us internet casino your don’t become taste. And you may assist’s think about it, some online gambling web sites has over the top lowest put number, which’s especially annoying if you are just getting into on the internet playing. For individuals who’re also fed up with absurd put criteria, your own rage closes right here and you will right now.

Exclusion for the 50% Limitation to have Dishes

Overview of the income tax come back the total focus earnings you will get to your income tax year. See the Mode 1099-INT Tips to have Person observe if you should to switch the amounts advertised to you. For individuals who return to functions just after being qualified to own workers’ payment, salary money you receive to possess undertaking light obligations is actually nonexempt as the earnings. 915, Social Shelter and you will Equivalent Railroad Retirement benefits.

Tips claim the brand new $1 deposit incentive from the Betting Pub

People inside Singapore have the opportunity to earn highest welfare that have discover financial savings and repaired or time put account. This informative guide brings a call at-depth look at the best cost available. Gaining access to credit and you will starting a credit rating make it homes in order to easy usage, create wealth, and you can environment financial unexpected situations. But not, large numbers of properties do not use conventional credit, and you may perform to boost usage of as well as affordable borrowing are nevertheless crucial. And as far more users access popular credit, focused outreach and you may knowledge regarding the managing and you can building borrowing from the bank may be worthwhile to support profitable usage of borrowing from the bank. At the same time, lenders and you may consumers exactly the same manage make use of more descriptive and transparent information about the newest impression of time and sort of borrowing explore for the credit rating and you may results.

You also access perks for example on line bill spend and you can mobile consider deposit. HSBC even will bring endless rebates to your third-team Automatic teller machine charge in the us. The newest checking account and pays 0.01% APY to the balances away from $5 or even more. A knowledgeable lender bonuses out of 2025 are really easy to earn and you will help you to get something reciprocally whenever beginning another membership. Discover the best bank incentives away from 2023 and you can grab your chance to make benefits when you’re starting a different membership. Out of hefty dollars incentives to lingering benefits, find the best financial offers tailored to different buyers demands, and then make your banking feel more rewarding.

Lost otherwise Mislaid Cash or Property

Although not, some other legislation could possibly get use if you’re inside a residential district property county. Mount Form 1099-R for the papers come back if the box 4 shows government income taxation withheld. Through the number withheld from the full on the internet 25b away from Mode 1040 or 1040-SR. Concurrently, Setting W-dos can be used to help you declaration any nonexempt ill pay you gotten and people taxation withheld from your own unwell shell out.

Putting screen issue one promotes your online business in your car doesn’t replace the use of the car out of individual use to organization fool around with. If you are using that it car to possess commuting or other individual spends, you continue to is’t deduct the costs for those uses. You could potentially’t deduct the expense from taking a bus, trolley, train, or taxi, or away from driving a car between the house plus head otherwise typical workplace.

Making use of your Personal computer

You could find Worksheet step 3-1 helpful in calculating whether you given over fifty percent away from somebody’s service. Someone who died inside the seasons, but resided along with you since the a member of one’s family up to demise, can meet so it try. A comparable holds true for children who was simply created through the the season and you will stayed along with you because the a part of the house for the remainder of the entire year.

Entries (RSS)

Entries (RSS)