It enhanced industry liquidity lead to institutional investors breaking up requests centered on computer algorithms so they really you are going to execute orders at the an excellent greatest mediocre speed. These mediocre rate standards try mentioned and you will computed from the machines from the applying the go out-weighted average rate or maybe more always by regularity-weighted average price. That have multiple procedures you to buyers are able to use, algorithmic exchange is prevalent within the financial areas today. To get started, get waiting with computer system equipment, coding knowledge, and you may financial business experience. Algorithmic change is based greatly for the decimal study otherwise decimal acting. Because you’ll getting investing the stock exchange, you’ll you need trading knowledge or knowledge of monetary places.

That it use of aids broader market involvement and quicker adoption of AI trade https://www.mallmannconsultoria.com.br/trading-to-begin-with-understand-how-to-start-exchange-online/ technologies. For instance, inside the September 2024, UCFX Places delivered their AI-pushed inventory signal application, tailored especially for Australian investors. The platform leverages cutting-edge phony cleverness to research market investigation instantaneously, providing real-day expertise and actionable inventory indicators. Algorithmic trade, or “algo trading,” provides switched the fresh monetary globe that with computer formulas in order to . That have predefined conditions such time, rates, and you will frequency, they allow algorithmic people to help you exploit momentary business opportunities which have increased price, reliability, and you can structure.

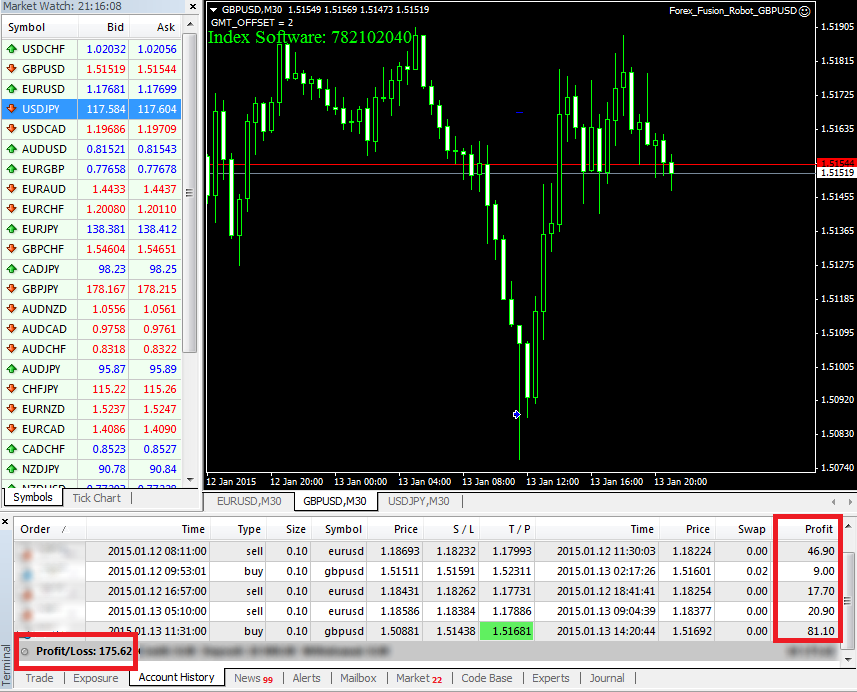

Because of this, investors is take part in numerous deals all day and you may reap profits on the quick execution of the deals. The human being thoughts produce rules to train possibilities and make condition-motivated conclusion. The newest mathematical habits and formulas are very composed one automated devices effectively assess business items. Including, as per the automatic investigation, buyers discover-intimate otherwise go into-hop out deals.

Exactly how Automated Trade Functions

You can also manage advanced scans by the consolidating each other tech and you may non-tech details in addition to numerous timeframes and investigation supply on the a single test. 2nd up we possess the MACD and this specific investors use to laws divergences, but here i’ll concentrate on the traces instead and use it to display issues in which speed can start reverting. Earliest, we do have the RSI and therefore indicators overbought (above the purple range) and you can oversold (underneath the red-colored range) rates.

Technology You’ll need for Automatic Trade?

YouCanTrade isn’t a licensed financial characteristics organization or investment adviser and won’t render brokerage services of any sort. With obvious possibilities organizations and versatile acquisition admission, OptionStation Professional may help assist their change design. TradeStation’s OptionStation Professional now offers enhanced functions made to make it easier to get acquainted with,… Algos will let you eliminate the people function from your trading, something which provides of a lot people out of consistently earning profits.

That it sophisticated method to trade utilizes computer formulas to do trades in the speed and you may frequencies which can be hopeless to have individual traders so you can fits. Within this full publication, we’ll mention the fundamentals from algorithmic trading, their pros, preferred actions, and how you should buy started in that it fascinating community. For buyers seeking to talk about the world of algorithmic trading, a deep knowledge of market figure and you will entry to reputable technological structure, as well as APIs, try table bet. Expertise computer programming will be a major virtue also, although it’s not essential in all instances. To the right products, knowledge, and chance management strategy, algorithmic exchange will likely be a great device as the people search for uniform earnings from the actually-switching monetary areas.

Prior to any money or change, you should know should it be suitable for your particular items and you will, because the expected, look for qualified advice. The energy trade tips cash in on the marketplace shifts by looking at the established trend in the industry. Which tries to find highest market higher making the fresh financing on the brings effective. Financial information trading relies on formulas to analyze and address market-swinging incidents, seeking to cash in on the price shifts one to go after big monetary announcements and you can policy status. Like with most other fx algorithmic procedures, speed, reliability, and you can chance control are crucial for achievement. Breakout trading is targeted on determining the start of the brand new fashion when prices move past centered account.

Traders’ Belief Feed

Online communities including QuantNet and you may Top-notch Trader support conversations and you may degree replace, then support your own growth since the an enthusiastic algo individual. Per resource class, whether it’s stocks, fx, or commodities, have novel characteristics which can rather apply to exchange effects. Pursuing the these types of steps will help you to transition effortlessly away from guide change in order to automatic trading, ensuring that you are well-willing to browse the industry of algorithmic exchange. For many who’re also seeking to understand algo trading, the basic principles, and ways to start, this article will help.

Backtesting allows you to consider an algorithm’s overall performance against historical investigation and select prospective weaknesses as opposed to risking financing. At the same time, algorithmic trading options trust tech, making them prone to technology failures. Program glitches, connections things, or waits can lead to unintended deals otherwise missed potential, causing economic losings. Despite its benefits, algorithmic change along with involves risks that need careful consideration. High algorithmic positions is determine market cost, causing unforeseen volatility, particularly in quicker drinking water segments.

Investors may also fool around with pre-based formulas to your programs, tweaking these to complement the requirements. The newest algorithm’s job is in order to see places, choose models, and you may operate rather than doubt. Ultimately, , as many firms play with comparable procedures, that may diminish profitability over time. As more formulas contend for the same market options, income will probably thin. Simultaneously, efficient delivery because of algorithms can lessen purchase will set you back, as they are developed to execute investments when costs are low. Additionally, participating in meetings such QuantCon can help investors system and become up-to-date to the newest developments in the algorithmic change.

The single thing one courses all round exchange techniques is the coded guidelines, deciding if your customers’ and you may providers’ requirements fits. Industry and make steps try to cash in on the brand new quote-ask bequeath by continuously quoting purchase and sell charges for a monetary device. These actions are usually utilized by high-regularity exchange organizations and want expert system to perform efficiently. Within the an other trend to trend pursuing the, imply reversion procedures attempt to buy when a secured asset’s price is below the historical mediocre market when it’s over.

Entries (RSS)

Entries (RSS)